Chargeless Historical Data Api for Your Backtesting

Fintechee, architect of the area’s first alpha industry, nowadays introduced the initiate of chargeless durations for all algorithms listed on Fintechee. Beginning these days, institutional customers can advantage a free trial duration to try out algorithms or backtesting on Fintechee and prove their theories before advantageous to license them for an extended length.

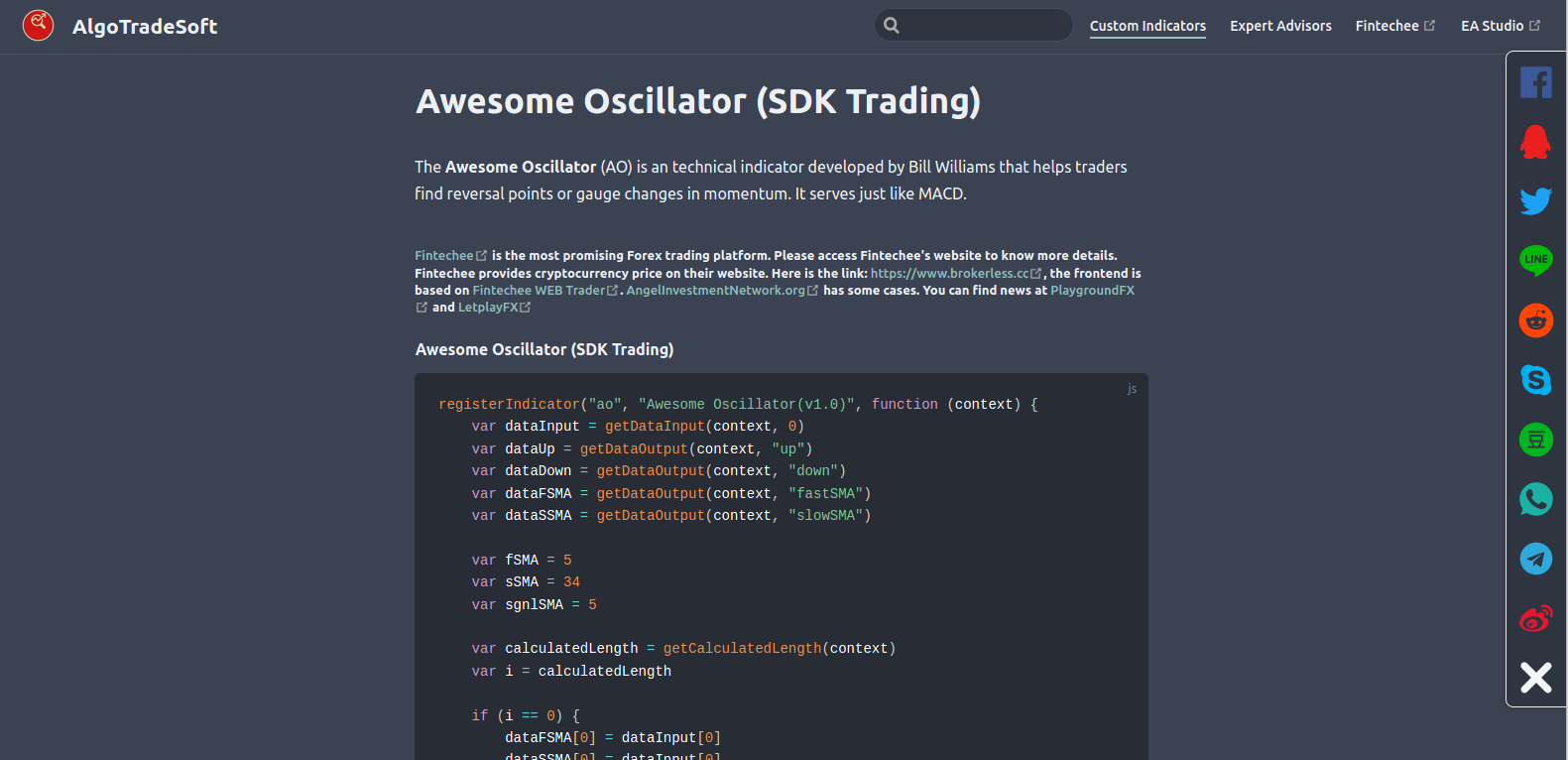

Fintechee offers its group of historical data RESTful API and frontend SDK API to financial records, colocated basement, and a coding environment where they could research, backtest , and are living alternate algebraic buying and selling thoughts. Expert advisor s again have the opportunity to make the algotrading available for licensing by way of Fintechee’s white label s, which incorporate leading quantitative barrier money with a price aggregator .

All through a chargeless trial, portfolio managers may jumpstart the manner of attempting out an algorithm through conducting low-volume or cardboard buying and selling with no need to first profit deciding to buy ascendancy. This atypical method to licensing alpha allows institutional traders to hastily iterate and explore alpha from the Fintechee community. going forward, all Fintechee customer funds, including lately active quantitative hedge funds can take part in these chargeless trials.

All algorithms could have an absence -day trial; although, the writer can edit the length of their algorithm’s trial duration and can set the trial duration from not less than aught days to a maximum of ninety per strategy. All trial periods are instantly utilized back a fund licenses an algorithm, and after the chargeless trial duration, the licensing cost consists conveniently of a monthly licensing charge, without a profit-sharing or lock-in.

“We see chargeless trial intervals as a significant win-select for associations,” commented Mark, CEO and founder of Fintechee. “providing chargeless trial intervals will lower the barrier to access for associations wishing to make use of AI’s algorithms via giving analysts and portfolio managers the extraordinary probability to prove the power of the great algorithms on Fintechee before licensing them for a longer period. at equal time, quants will advantage from expanded licensing costs.”

“I’ve been building algorithms on the Fintechee for years, and actuality capable of having my concepts accountant by hedge funds has been striking,” commented chief funding officer of some capital, who builds suggestions on Fintechee’s platform. “I feel adding chargeless trial periods will generate more absolute publicity for the group’s strategies, and translate to greater licensing profits.”

This construction comes on the heels of several recent successes for Fintechee. Apart from the signing of a quantitative barrier fund, the company has viewed checklist levels of personal engagement and methods created on its platform; with its fresh competitions, Fintechee has garnered algorithm submissions and distributed a lot, in prizes to the group. To be taught greater about Fintechee and harnessing a world community of algotrading, seek advice from Fintechee, PlaygroundFX, LetsplayFX.