ETF vs Mutual Fund

ETF vs Mutual Fund

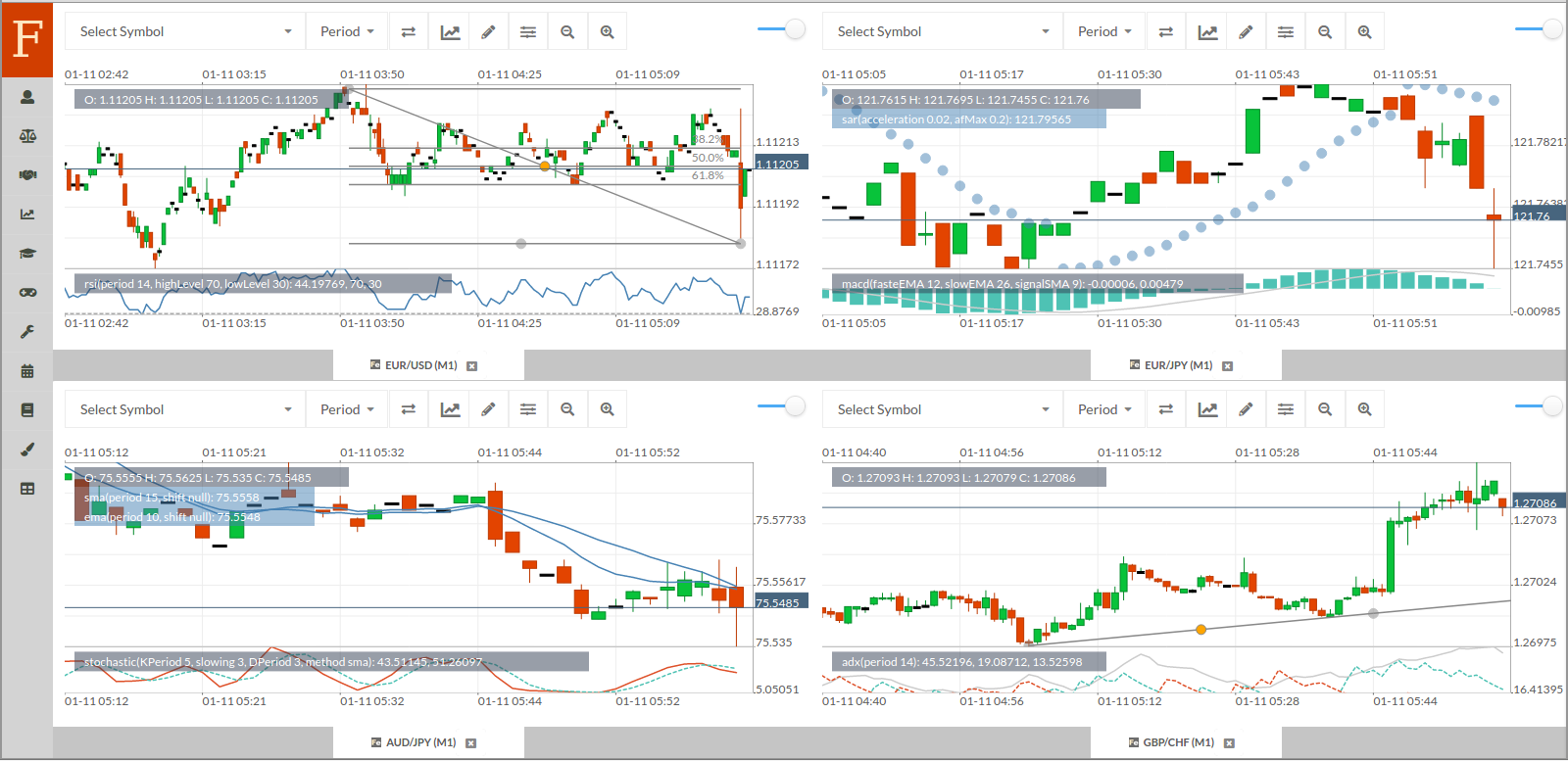

Fintechee provides cryptocurrency price on their website.

Here is the link: https://www.brokerless.cc, the frontend is based on Fintechee WEB Trader

AngelInvestmentNetwork.org has some cases.

ETF s are more tax effective than mutual cash. assuming an ETF and an alternate fund accept the identical complete return, the ETF will grow at a faster pace as a result of its tax skills. In this article, we are going to seem to be on the key causes in the back of the tax efficiency of ETF s and discuss how they examine to a standard mutual fund.

Mutual funds

To be burdened as an adapted investment enterprise RIC, mutual money needs to accommodate a few requirements. One of these is the claim to administer as a minimum % of its net investment revenue to shareholders every year or be subject to an excise tax. IRS laws crave that alternate cash distribute 98% of its common salary earned right through the yr, 20% of its internet basic gains becoming all over the duration ending in October, and % of any before now undistributed amounts. In practice, most alternate money administers 5% of earnings and basic features every year.

As a result of a mutual fund is a circulate-via entity, the actor is accountable for any tax due to these distributions. Here s why an investor should still never invest in a mutual fund simply previous to a capital positive factors distribution, which usually occurs in December. In brief, a broker in an alternate fund will be required to pay tax on all taxable distributions, even though the broker is reinvesting capital good points and dividends and notwithstanding the broker experiences an accident all through the calendar months. a lot of this is the same with ETF s however there s one different change.

ETFs

ETF s have been shooting market allotment for reasonably a while. as an instance, by using year-end, the amount of property in ETF s changed into $ billion, representing a bazaar share. As of December, this had grown to $4 trillion or 1% bazaar share. despite the fact this represents a significant increase, belongings in ETF s still lag mutual money which, as of the same December date, had over $3 abundance in assets.

There are many motives ETF s proceed to remove the popularity challenge. Apart from day by day accuracy and intra-day pricing, ETF s have a distinct tax potential over mutual money. There are a few explanations for this. Based on Jim Rowley, chief funding Analyst with forefront. The overwhelming quantity of an ETF ’s tax effectivity is because of it being a basis fund, and basis money is typically more tax productive than lively management.

Rowley additionally cited that over % of all ETF s are listed. Despite the fact, there may be a further, greater concealed reason for an ETF s tax effectivity. This rationale is attributed to an ETF s constitution, which results in beneath long-time period capital positive aspects distributions. How does this work? How does this vary from an alternate fund?

ETFs versus alternate money: Taxation Overview

ETF s hang knowledge over mutual dollars. Right here’s where they are the same. Shareholders of both pay any tax due to the salary, assets, and short-time period basic features that might be allotted. Youngsters, with an ETF , shareholders are a great deal less likely to be discipline to long-term basic good points. To have in mind why we need to bear in mind the structure of both of those gadgets.

Regarding the illustration under alternate fund structure, back an actor invests in a mutual fund, they accomplish that by changing money for shares of the fund. The fund will again make investments the profit stocks, bonds, and many others. The secret is that investor s are authoritative a money-for-shares alternate at once with the fund.

Mutual fund constitution

Conversely, back a broker invests in an ETF , the investor exchanges cash for fund shares, however, the trade is amid an investor and a licensed actor AP and not directly with the fund. To make clear this, we need to take into account how the ETF shares are created see alternate-Traded fund constitution beneath. Shares in an ETF are created through an AP. An AP can be a bazaar maker, a huge investor , a professional or an institutional broking service broking. aboriginal, an AP will purchase a bassinet of balance during the capital markets which represents the holdings within the ETF . again, the AP provides the balance to the fund custodian in change for shares within the ETF , known as ETF creation devices. This exchange is accomplished. in-variety. eventually, the AP sells the shares to the broker. Since the alternative is considered to be in-form and is between the AP and the fund custodian, the actor is less likely to be faced with lengthy-term capital good points. Of direction, when the actor finally sells the ETF , they are going to pay tax on the profit within the allotment cost, if any.

ETF structure

As ETF s continue to develop in popularity, they should still proceed to capture market allotment. Despite the similarity within the taxation of alternate cash and ETF s, the structural difference and talents absence of lengthy-term capital gains in ETF s makes them an acute investment car. Accompanying after-day appraisement, daily liquidity and accuracy, as buyers learn greater about them, belongings in ETF s might also sooner or later beat mutual funds.